Understanding the Consumer Price Index (CPI): A Key Measure of Inflation

Changes in the Cost of Living

Inflation is one of the most critical economic indicators affecting both individuals and businesses. It dictates the purchasing power of money, influences interest rates, and shapes government policies. But how do we measure inflation effectively? One of the most widely used tools for this is the Consumer Price Index (CPI).

In this post, we’ll break down what CPI is, how it’s calculated, why it matters, and its impact on everyday life.

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is a measure of the average change in prices over time for a fixed basket of consumer goods and services. This basket includes everyday necessities such as:

Food and beverages (groceries, dining out)

Housing (rent, utilities, home maintenance)

Transportation (fuel, public transit)

Medical care (doctor visits, prescription drugs)

Apparel (clothing and footwear)

Recreation & education (books, entertainment, tuition)

CPI serves as an inflation benchmark, helping policymakers, businesses, and consumers understand how the cost of living evolves over time.

How is CPI Calculated?

The Bureau of Labor Statistics (BLS) in the United States collects price data for thousands of items each month across different regions. Here’s how the CPI calculation process works:

A "basket" of goods and services is defined, representing common household expenses.

Price changes for each item are recorded from multiple locations.

Weighting is applied based on how much the average consumer spends on each category.

The overall price index is computed, showing the percentage change in prices over time.

If CPI rises, it means inflation is increasing, making goods and services more expensive. If CPI decreases (deflation), prices are falling, which can indicate economic slowdowns.

Why CPI Matters

CPI plays a crucial role in multiple aspects of the economy:

1. Measuring Inflation

Since CPI tracks changes in consumer prices, it’s a primary inflation indicator. Rising CPI means higher inflation, which can erode purchasing power.

2. Adjusting Wages & Social Security

Governments and businesses use CPI to adjust wages, pensions, and benefits. For example, Social Security payments in the U.S. are indexed to CPI to ensure they keep pace with inflation.

3. Guiding Economic Policy

The Federal Reserve and policymakers analyze CPI trends to make monetary policy decisions, including setting interest rates to control inflation.

4. Impacting Interest Rates

If CPI indicates high inflation, the Federal Reserve may raise interest rates to slow down the economy. Conversely, if inflation is low, they may lower rates to stimulate spending.

Limitations of CPI

While CPI is a widely used inflation measure, it has some limitations:

It may not reflect personal spending patterns – Not all households spend the same way, so CPI may not match individual cost-of-living experiences.

It doesn’t account for product quality changes – If a new smartphone is more expensive but has better technology, CPI sees only the price increase, not the improved value.

Housing costs can be tricky – Homeownership costs (like mortgage interest) aren’t directly included in CPI, which can understate real living expenses.

To address these concerns, economists also track Core CPI, which excludes volatile food and energy prices, and Personal Consumption Expenditures (PCE), which the Federal Reserve prefers for policy decisions.

How CPI Affects You

CPI influences everyday financial decisions. Here’s how it impacts you:

✔ Higher CPI = Higher Prices: Groceries, gas, rent, and healthcare may become more expensive.

✔ Interest Rates May Rise: Loans, mortgages, and credit cards could cost more.

✔ Wages & Benefits May Increase: Employers may adjust salaries to keep up with inflation.

✔ Investment & Retirement Planning Shifts: Inflation erodes the value of savings, making inflation-hedged assets (like stocks, gold, or real estate) more attractive.

Understanding CPI helps you make informed financial choices, from budgeting effectively to planning for inflation-adjusted retirement savings.

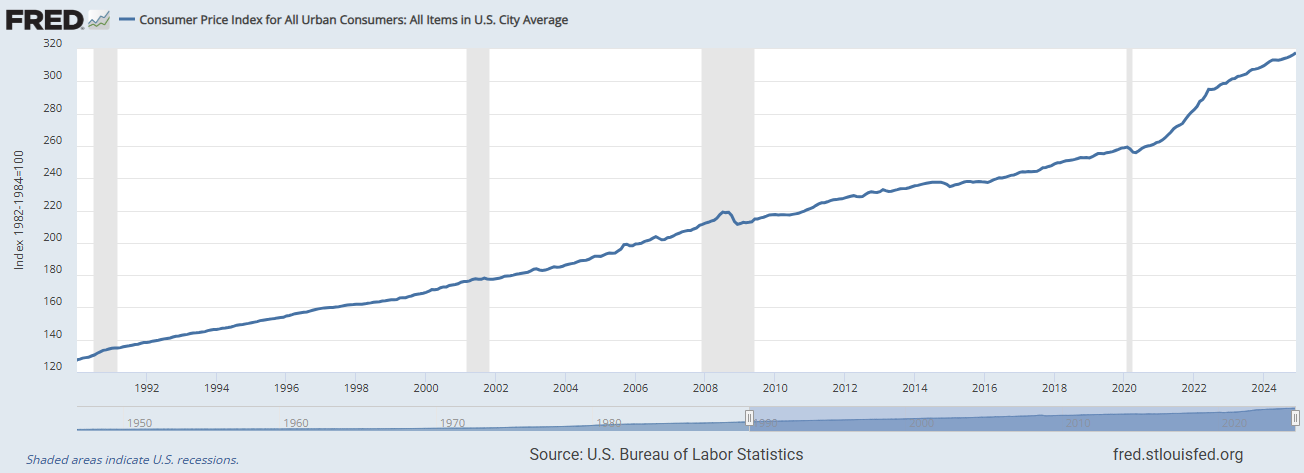

Below is a chart displaying the Consumer Price Index (CPI) for all urban consumers from 1990 to the present, sourced from FRED. The sharp rise in inflation over the past three years is evident, reflecting the impact of excessive government spending and inefficient use of taxpayer funds.

Final Thoughts

The Consumer Price Index (CPI) is a powerful tool for tracking inflation and understanding shifts in the cost of living. Whether you're a policymaker, business owner, or everyday consumer, keeping an eye on CPI trends can help you navigate economic changes wisely.

Want to stay ahead of inflation? Monitor CPI reports, adjust your financial strategy, and ensure your income keeps pace with rising costs.